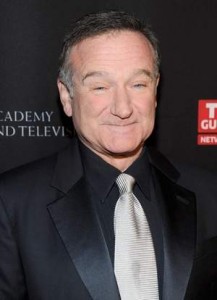

One year after the death of Robin Williams, a legal battle over his estate continues.

One year after the death of Robin Williams, a legal battle over his estate continues.

Despite the fact that Williams’ estate was planned with a certain degree of sophistication, several disputes have arisen between his widow and his three children from two previous marriages. Williams’ estate plan provides that his widow be able to live in their mansion in Tiburon, California, and retain most of its contents. However, Williams’ children claim that the home contains memorabilia items that are designated for them. Another area of dispute concerns a fund dedicated to expenses associated with the residence, which Williams’ widow claims is being restricted by his children.

Many wealthy people die having done inadequate estate planning, or none at all, which is almost certain to lead to legal disputes among heirs. In Williams’ case, the actor and comedian had done the right thing for the most part, creating a tax-efficient estate plan that included trusts to be managed by people in whom he had confidence. However, this did not prevent legal turmoil after his death.

Estate planning experts familiar with Williams’ estate say that a lesson that can be learned from this case is that specificity is essential to proper estate planning. Especially when personal items are to be left to different people, specifically naming individual items is much better than using general language to describe categories of possessions. Leaving things open to interpretation is one way that disputes can arise. Another factor that can help prevent disputes is to set expectations by letting loved ones know the general plan for the estate, so that they are not surprised by its provisions.

Learn more about our services by visiting www.elderlawnewyork.com.

Was this article of interest to you? If so, please LIKE our Facebook Page by clicking here.

Along with the number of seniors with housing debt, the average debt amount is also growing. In fact, according to the financial protection bureau, since 2001 the average debt has more than doubled for people age 65 and older, from $43,400 to $88,000.

Along with the number of seniors with housing debt, the average debt amount is also growing. In fact, according to the financial protection bureau, since 2001 the average debt has more than doubled for people age 65 and older, from $43,400 to $88,000.

While cognitive declines associated with Alzheimer’s diseases and other dementias are well-known, most people are unaware that seniors without dementia are also at risk for cognitive impairment, particularly in financial issues.

While cognitive declines associated with Alzheimer’s diseases and other dementias are well-known, most people are unaware that seniors without dementia are also at risk for cognitive impairment, particularly in financial issues.